- Basic small business bookkeeping how to#

- Basic small business bookkeeping software#

- Basic small business bookkeeping free#

Open a business checking account and a business savings account Make sure you compare a few options-and take note of requirements such as maintaining a minimum balance-before settling on a bank. For example, some banks offer no-charge business checking accounts. It’s a bonus if the bank proactively caters to small businesses. What kind of fees are they going to charge you?ĭoes the bank also offer business savings accounts and business credit cards? What does the bank offer in terms of security and fraud protection?Ĭan they provide access to a line of credit?ĭoes the bank’s online banking option let you designate separate users (for business partners, if necessary)? Is it okay if the bank is online only? Or will you need in-person access at a nearby branch?ĭoes the bank work well with your Point of Sale (POS) system, if you use one?

Here are some guiding questions to consider while you’re comparing options: The “right bank” for you will depend on the nature of your business and the way you prefer to get your banking done. When you’re shopping around for a bank that offers small business bank accounts, remember: every business is different. What records and paperwork do I need to keep on file? What can I do throughout the year to reduce my tax bill? How does the legal structure of my business affect tax filing?ĭoes my business have a sales tax nexus in another state? What other types of business insurance do I need? What is the best legal structure for my business?ĭo I need to register for a payroll solution? Make sure you’re clear on all of the accounting obligations related to managing and growing your business. Once you’ve chosen an accountant to work with, use these top questions to ask a CPA to guide your initial conversation. Most charge hourly, but some may ask for a monthly retainer. How much a CPA costs depends on a couple different factors like the size of your operations. Discuss rates upfrontīe sure to discuss any prospective CPA’s rates during the consultation.

Basic small business bookkeeping free#

Any CPA should be willing to sit down with you for a free consultation. Once you have a few leads, contact them individually. Ask other business owners in your niche for referrals. It’s best to work with a CPA who has experience with clients in your industry.

No previous accounting or bookkeeping experience necessary.ĭisclaimer: While this program aims to provide you with bookkeeping skills, completion is not a guarantee, or condition, of employment at Intuit or in the bookkeeping field.If you’re serious about growing and (eventually) selling your business, you need to team up with a Certified Public Accountant (CPA) early on.īeyond filing your tax return, an experienced CPA can help you with:Ī CPA can also help you make long-term, big picture financial decisions about the future of your business.

Basic small business bookkeeping software#

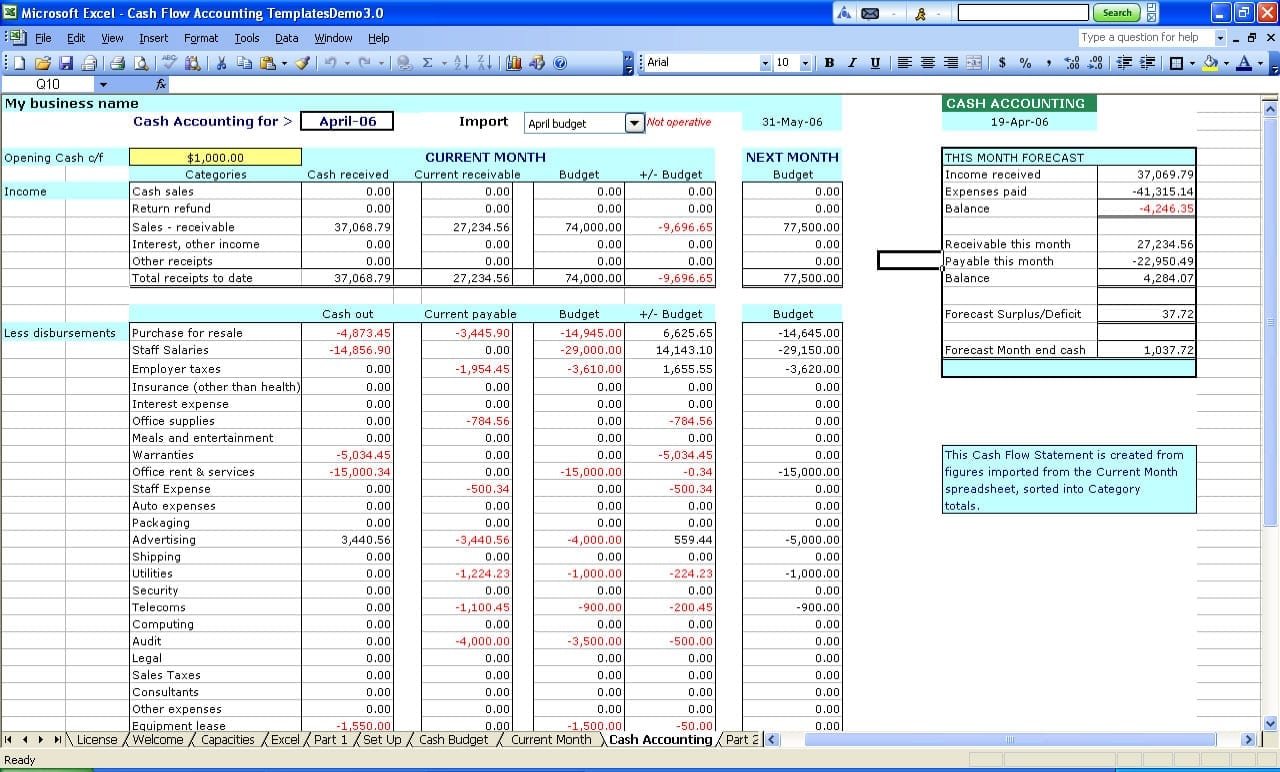

You will need access to spreadsheet software (Excel, Google Sheets, Numbers or the equivalent) for some activities in this course. Practice interpreting and analyzing financial statements to make key business decisions.

Basic small business bookkeeping how to#

Learn how to work through the phases of the accounting cycle to produce key financial statements. Build a foundation of bookkeeping concepts and accounting measurement.

With this certification, you will be qualified to apply for a position as a bookkeeper at Intuit QuickBooks Live or anywhere in the field. Upon completion, you’ll be ready to take the Intuit Academy Bookkeeping exam. You’ll gain a foundational understanding of accounting principles and an introduction to QuickBooks Online through hands-on practice working with real-world accounting scenarios. If you are detail-oriented and passionate about solving clients’ problems, this program is for you. Whether you are starting out or looking for a career change, the Intuit Academy Bookkeeping program prepares you for a variety of jobs in public accounting, private industry, government, and non-profit organizations-and for the Intuit Academy Bookkeeping exam.

0 kommentar(er)

0 kommentar(er)